The cryptocurrency market is open to everyone, but understanding its fundamental principles is key to success. How do market cycles, seasonality, and automation help maximize earnings? Here are the key takeaways from the recent speech by Oleksandr Orlovskyi, founder of Financial Freedom Academy (FFA), at the MBC Business Club forum in Vienna.

Oleksandr Orlovskyi is a crypto expert well-known in European and Asian countries. He is the author of educational courses, an official partner of the crypto exchange ByBit, and a consultant for new blockchain and NFT projects. His success story is inspiring: born and raised in Kyiv, he graduated from school and enrolled at a university in Poland. To make a living, he worked as a bartender in his free time. A casual conversation introduced him to crypto — he gave it a try, and within a few years, he had become a top crypto investor.

Today, Oleksandr Orlovskyi’s net worth exceeds $1 million — money he made through crypto. With his profits, he bought an apartment in Dubai and several luxury cars. He travels frequently and gives expensive gifts to his loved ones. As of the end of 2024, the FFA he founded ranked among the top 5 crypto communities in Eastern Europe.

Oleksandr Orlovskyi awarding top FFA students

Key Takeaways from Oleksandr Orlovskyi’s Speech at the MVS Business Club Forum

1. How Crypto Differs from Traditional Currencies

Oleksandr Orlovskyi began his speech by comparing digital currencies to securities and precious metals: “Cryptocurrencies are more comparable to stocks or gold than to fiat currencies. Bitcoin is not a competitor to the dollar — but it is a direct competitor to gold.” The expert explained that traditional currencies like the dollar or euro primarily serve as a medium of exchange for daily transactions and are regulated by central banks. In contrast, cryptocurrencies (digital assets), like gold, have limited issuance, can store value over the long term, and are protected from inflation thanks to their decentralized nature.

2. Accessibility of the Crypto Market

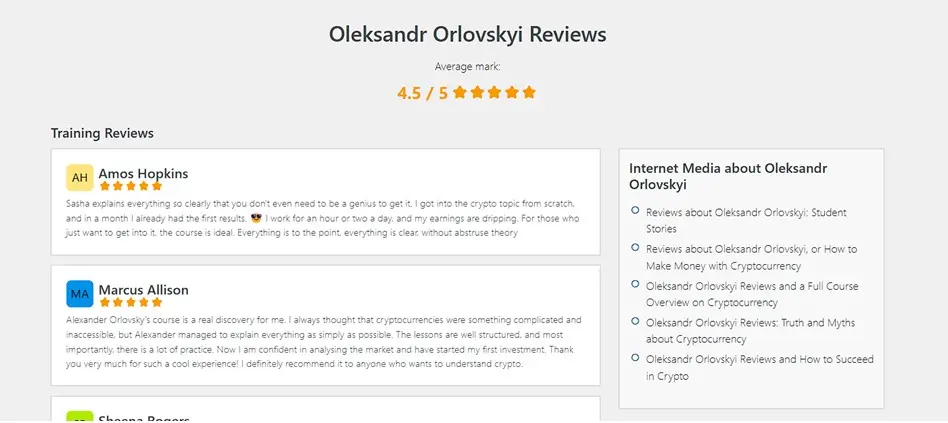

“Crypto is the most accessible financial market, operating 24/7 with unlimited liquidity. It allows anyone to start trading with a small amount — even as little as €10 — or even without initial capital,” says Oleksandr Orlovskyi. To support his point, he shares examples from FFA’s practice. Over 20,000 people have received training through the FFA crypto community. Two out of seven courses are designed for experienced investors, while the rest are for complete beginners. Many students join the course with no starting capital or with only a minimal deposit. The results are impressive: on average, students earn around $2,000 during the training itself. The highest earnings by one of Oleksandr Orlovskyi’s students exceed that amount by nearly 100 times. These results are backed by screenshots — FFA values statistics.

Oleksandr Orlovskyi with a member of the FFA Level X Club community

3. Market Cycles and Predictability

Crypto follows a four-year cycle, primarily influenced by Bitcoin halvings, which reduce mining rewards by half. “Currently, the market is in the middle of a growth phase,” shared Oleksandr Orlovskyi. According to the FFA founder, understanding the market’s cyclical nature allows investors to better plan their buying and selling strategies. Oleksandr Orlovskyi emphasized that following a halving (the most recent occurred in April 2024 — ed.), Bitcoin’s value traditionally shows an upward trend for 12–18 months, making this period the most favorable for growing an investment portfolio.

4. Seasonal Trends in Crypto

Historically, crypto prices tend to rise during the colder months — from late autumn through winter and early spring. Oleksandr Orlovskyi explains that this isn’t just an observation. This pattern has been consistent for the past 14 years. The expert commented, “In winter, people spend more time at home, sitting at their computers. As a result, they tend to take more interest in investments and are more willing to take risks to increase their capital before the summer vacation season. Taking this seasonality into account allows you to significantly optimize your trading strategy.”

FFA Level X Club birthday celebration

5. The Potential of Low-Cap Coins

Lower-value cryptocurrencies have greater growth potential. While Bitcoin may double in price, smaller assets often experience exponential surges. For example, Solana (SOL) gained 10x in a year, while PEPE surged 25x. FFA founder Oleksandr Orlovskyi explains this with simple market logic — coins with lower market caps require much less inflow of funds to significantly raise their price. “It’s like comparing a large ship to a small boat — it takes a lot more effort to move the ship,” says Oleksandr Orlovskyi. He advises investors to build a balanced portfolio that includes reliable but slow-growing assets like Bitcoin and Ethereum alongside promising altcoins that can deliver high returns with an acceptable level of risk.

6. Profiting from Market Corrections

Oleksandr Orlovskyi says, “Without price fluctuations, traders wouldn’t be able to profit. Understanding the rhythm of crypto market cycles allows investors to buy low and anticipate future growth.” The FFA founder explains that market corrections are not disasters, but opportunities to multiply capital. According to him, experienced investors wait for downturns to buy assets at attractive prices. “It’s like a sale at a store — why not take advantage of a discount on something you trust the quality of?” Oleksandr Orlovskyi adds that it’s crucial to have available funds at the time of a market dip. He recommends not investing your entire capital at once but rather keeping a reserve for such opportunities.

Photo from an FFA Level X Club meetup

7. Automated Trading

Algorithmic trading bots can generate consistent profits — even for beginners. With conservative settings, automated trading can yield returns of 15–20% per month. Oleksandr Orlovskyi again shares FFA’s statistics: one of the favorite tools available to community members is a trading bot that operates 24/7. The record profit earned with it is $2,736,282.

8. Diversifying Your Portfolio

Oleksandr Orlovskyi believes the optimal strategy is a balance between conservative assets (such as Ethereum, Bitcoin, and Solana) and high-risk, high-reward meme tokens. “In FFA programs, we teach that a crypto portfolio is like a ‘pie’ divided into slices. The largest portion — about 60-70% — should be held in market giants like Bitcoin and Ethereum. They provide stability and long-term growth. Another 20-25% of the portfolio should be distributed among promising altcoins with strong technological solutions and communities, such as Solana or Cardano. And a small portion, up to 10%, can be allocated to high-risk but potentially high-reward meme tokens like PEPE or DOGE. They’re like lottery tickets — sometimes they hit, and even if they don’t, your core capital stays safe,” says Oleksandr Orlovskyi.

One of Oleksandr Orlovskyi’s students

9. ETFs and Institutional Investments

This year, leading global investment funds received approval for Bitcoin and Ethereum ETFs. The launch of these ETFs in the US provides institutional investors with easier access to the crypto market, fueling further growth. This could be a key driver for the market in 2025.

10. Crypto: The “Younger Brother” of the Stock Market

“The crypto market is currently 40–50 times smaller than the stock market, but it has the potential to catch up. While many focus on blockchain technology, the real drivers of the market are institutional funds, market makers, strategic manipulations, speculative price surges, and unexpected downturns,” summarized Oleksandr Orlovskyi.

Crypto conference hosted by FFA

The Future of Crypto: A Growing Financial Powerhouse

While discussing investment strategies, the expert emphasized the importance of choosing your approach. “Holding crypto assets for years like Michael Saylor does, or actively trading — it’s like choosing between planting a garden and picking wild berries. Both approaches work, but they require different efforts and temperaments,” Oleksandr Orlovskyi explained. “Long-term investors can sleep peacefully, not worrying about daily market fluctuations. But they need patience. Traders profit from short-term movements but spend several hours a day on the market and face significantly higher emotional stress.”

Oleksandr Orlovskyi also warned the audience about common beginner mistakes. One of the most frequent is the lack of a clear plan and strategy. He says many people try to enter the market emotionally, tempted by instant profits. The expert cautions that it’s important to have a clear entry plan — and most importantly, not to invest all your money in a single asset. Another common mistake is panicking during market corrections. Oleksandr Orlovskyi emphasized that experienced investors know how to wait and use price drops to grow their positions. He also noted that it’s crucial to constantly improve your knowledge and strategies, as the crypto market is constantly evolving. One reliable way to do this, he says, is by joining Oleksandr Orlovskyi’s FFA. The founder of the crypto community walked through several case studies and explained how students manage to earn with no budget (record: $198,938), on spot trades ($1,679,637), through retro and ICOs ($476,931), and in trading ($1,393,96).

Photo of Oleksandr Orlovskyi’s students

In conclusion, cryptocurrencies are becoming an integral part of the global financial system, with massive growth potential. A well-researched strategy and careful market analysis allow even newcomers to achieve consistent profits in the crypto space.

Also Read-Minimizing Treatment Discomfort with High-Tech Solutions